As domestic demand wanes, China Construction Machinery Export is surging, positioning the country as a rising global force in 2025.

According to customs data, from January to April 2025, China’s construction machinery exports reached USD 18.07 billion—a 9.01% year-on-year increase. In April alone, exports totaled USD 5.152 billion, reflecting a 12.7% year-on-year rise.

Excavators, the industry’s bellwether product, echoed this trend. A total of 34,405 units were exported in the first four months of 2025, marking a 9.02% annual increase. April’s export volume stood at 9,595 units, up 19.3% compared to the same period last year.

What’s Fueling the Growth in China Construction Machinery Export?

Internal Drivers

1. A Robust and Expanding Industrial Chain

China’s increasingly sophisticated and complete industrial supply chain has laid the groundwork for global expansion. From production to logistics, Chinese manufacturing has become fiercely competitive on the world stage—and that competitiveness continues to strengthen.

Take, for instance, the China–Kyrgyzstan–Uzbekistan (CKU) Railway. The groundbreaking ceremony took place in Jalal-Abad, Kyrgyzstan in December 2024. Construction is slated to begin in July 2025 with a six-year timeline. Once completed, the railway will become the shortest overland route linking China with Central Asia. It will shave roughly 900 kilometers off the current journey and save 7–8 days of transport time. For Chinese construction equipment manufacturers, this project opens up a strategic corridor into Central Asia—boosting both brand visibility and distribution networks.

2. Performance and Technological Maturity

The rising technical standards of Chinese construction machinery are accelerating overseas adoption. Domestic machines now offer a compelling cost-to-performance ratio. Most notably, advancements in research and development have led to the domestication of previously imported core components, reducing dependency on foreign brands.

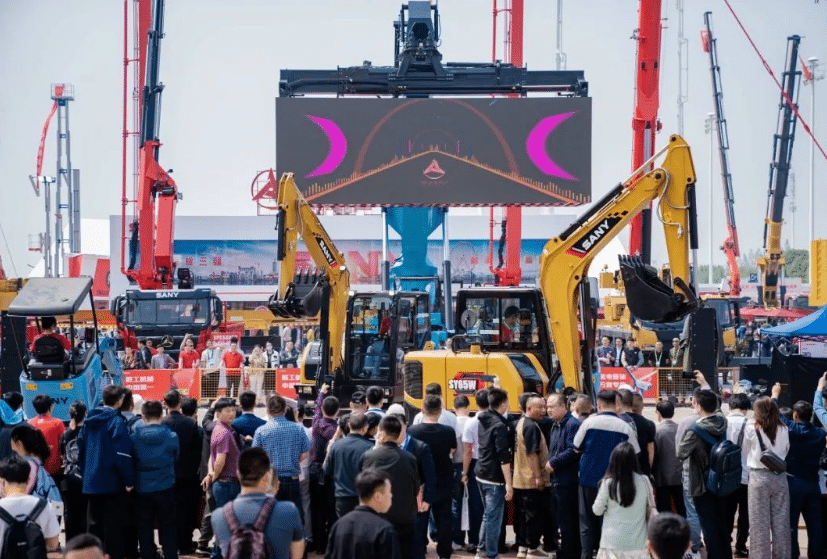

During the Changsha International Construction Equipment Exhibition on May 16, Zoomlion hosted a high-profile product launch for its mining machinery division. The company unveiled 15 large-scale, electric-powered, and unmanned mining machines, including excavators, mining trucks, loaders, and bulldozers—totaling 23 new models. All were equipped with fully localized core components, demonstrating China’s ascent in high-end machinery innovation.

External Drivers

1. Steady Growth in Traditional Markets

Indonesia continues to lead as a key export destination. In Q1 2025, Chinese excavator exports to Indonesia reached USD 230 million, accounting for 10.15% of total shipments—amounting to 4,477 units. The country’s ongoing infrastructure boom and increasing mineral extraction projects remain central to this demand.

Russia, ranking second, imported USD 189 million worth of Chinese excavators, totaling 1,788 units. Bilateral trade ties, coupled with strategic development in Russia’s Far East, are driving the country’s appetite for Chinese machinery. Market analysts widely expect sustained growth in this region.

2. Surging Demand in Emerging Markets

West Africa is rapidly gaining attention. In Q1 2025, China exported USD 93 million worth of excavators to Guinea—an impressive 317.2% increase from the same period in 2024. Similarly, exports to Mali surged 409.2% year-on-year, reaching USD 72 million.

This uptrend reflects both infrastructure gaps and rich resource reserves. African nations, with 30% of the world’s known mineral wealth, are seeing heightened demand for excavators, bulldozers, and other mining-related machinery. Simultaneously, underdeveloped transportation and urban infrastructure make construction equipment indispensable.

Rising Challenges for China Construction Machinery Export in Global Expansion

As Chinese construction equipment companies go global, they also encounter increasing risk and competition. Four notable challenges are emerging:

1. Overcompetition Among Chinese Firms Abroad

With lackluster domestic demand and intensified rivalry at home, “go global or go under” has become a common refrain. As more Chinese companies flood overseas markets, competitive pressures are spilling beyond borders—repeating the same cutthroat tactics seen domestically.

2. Pressure from Global Heavyweights

As Chinese brands expand internationally, global giants like Caterpillar and Komatsu have employed a mix of tactics—ranging from technological embargoes to intellectual property litigation—to hinder their advance. Meanwhile, new challengers from India and Turkey are capturing low-to-mid-end market share with ultra-competitive pricing. This dual squeeze is narrowing the playing field for Chinese exports.

3. Geopolitical and Regional Instability

Political uncertainty in some regions poses latent risks. For instance, the first phase of the China–Thailand railway was originally scheduled to launch in 2020, but progress has stalled with only 35% completed as of 2025. Delays stem from local land acquisition issues and political infighting, underlining the risks of operating in volatile environments.

4. Trade Barriers and Tariff Risks

In April, the U.S. triggered a fresh wave of trade tensions with tariff hikes. While May’s export data is yet to be released, analysts expect a negative impact on Chinese machinery exports to the U.S. market. Meanwhile, both the EU and U.S. have erected technical trade barriers and increased duties, making market penetration in developed regions even more challenging.

Industry Outlook for 2025: Mixed Optimism with Regional Variance

What lies ahead for China’s construction machinery industry?

A series of industry leaders have weighed in:

- Zhou Jun, Deputy Party Secretary and General Manager at Anhui Heli Co., Ltd., calls the outlook “cautiously optimistic.”

- Zhuo Puzhou, Deputy Party Secretary and GM of CRCHI, predicts flat domestic growth but moderate gains overseas.

- Li Shizhen, Chairman of Shantui Construction Machinery Co., sees 10–15% domestic growth and 10% overseas.

- Fei Chunjiang, Chairman and GM of Komatsu (China), remains “relatively optimistic,” expecting over 10% growth in excavators.

- Wang Liping, Chairman of Hengli Hydraulic, expects both 2025 and 2026 to show upward trends.

Despite macroeconomic headwinds and external frictions, the momentum of Chinese machinery exports appears resilient. With strategic planning, innovation, and market responsiveness, Chinese brands remain well-positioned to solidify their footprint on the global stage.